iowa disabled veteran homestead tax credit

Section 42515 - Disabled veteran tax credit 1. Iowa Property Tax Credit Military Tax Exemption.

Iowa disabled veteran benefits encourage homeownership by providing 100 exemption of property taxes for 100-disabled service-connected veterans and Dependency and Indemnity Compensation DIC recipients.

. Iowa disabled veteran benefits encourage homeownership by providing 100 exemption of property taxes for 100-disabled service-connected veterans and Dependency and Indemnity Compensation DIC recipients. Originally adopted to encourage home ownership for. The Tax Management Division of the Iowa Department of Revenue is responsible for all facets of tax processing from.

The current credit is equal to 100 percent of the actual tax levy. Originally adopted to encourage home ownership for disabled veterans. Change or Cancel a Permit.

Disabled Veterans Homestead Tax Credit Application. Veterans of any of the military forces of the United States who acquired the homestead under 38 USC. The current credit is equal to 100 of the actual tax levy.

Sections 21801 21802 or 38 USC. 3 For persons applying for the disabled veteran tax credit under Iowa Code section 425151b andc a US. This is a 100 exemption for property taxes for qualifying residences used by veterans as their home.

Disabled Veterans Homestead Tax Credit. Department of Veterans Affairs Benefit Summary Letter also known as a Veterans Affairs award letter stating the veterans qualifying service-connected disability ratings is required with an application for the disabled veteran. Disabled Veteran Homestead Property Tax Credit Iowa Code section 42515 and Iowa Administrative Code rule 7018013 54-049a 10192020 This application must be filed with your city or county assessor by July 1 of the assessment year.

Veterans as defined in Iowa Code section 351 of. A veteran of any of the military forces of the United States who acquired the homestead under 38 USC. File a W-2 or 1099.

Veterans with 100 percent service-related disability status qualify for this credit. If the owner of a homestead allowed a credit under this chapter is any of the following the credit allowed on the homestead from the homestead credit fund shall be the entire amount of the tax levied on the homestead. Upon the filing and allowance of the claim the claim is allowed on that homestead for successive years.

Based on information provided by the Department of Veterans Affairs the Department of Revenue estimates that 4310 additional veterans will apply and qualify for the credit if the permanent service-connected disability. Disabled Veterans Homestead Tax Credit. The State of Iowa offers a Homestead Tax Credit to qualifying disabled veterans with permanent and total disability ratings based on individual unemployability paid at the 100 disability rate.

The current credit is equal to 100 of the actual tax levy. The Disabled Veteran Homestead Tax Credit will continue to be fully funded through the existing standing unlimited State General Fund appropriation. IOWA Application for Disabled Veteran Homestead Tax Credit Iowa Code Section 425.

10000 from the property value. Veterans also qualify who have a permanent and total disability rating based on individual. Owners of homesteads were eligible for a homestead tax credit equal to the entire tax value assessed to the homestead if they fell into one of the following categories.

12000 from the property value. The bill modified the existing homestead tax credit to include disabled veterans with a permanent disability rating. You can find the form on the Iowa Department of Revenue website under Disabled Veteran Homestead Property Tax Credit.

Iowa State Disabled Veteran Homestead Tax Credit. A veteran of any of the military forces of the United States who acquired the. Back in 2015 House File 166 was signed into law.

A surviving spouse or child who receives dependency and indemnity. 42515 Disabled veteran tax credit. This tax credit provides 100 exemption of property taxes for 100 disabled service-connected veterans and Dependency and Indemnity Compensation DIC.

July 1 The veteran must have a permanent and total disability rating service-connected or individual unemployability rating that is compensated at the 100 disability rate as certified by the United States department of veterans affairs. This helps veterans pay for their property taxes. Based on your disability rating you will be asked to fill out different forms.

If the owner of a homestead allowed a credit under this subchapter is any of the following the credit allowed on the homestead from the homestead credit fund shall be the entire amount of the tax levied on the homestead. Originally adopted to encourage home ownership for disabled veterans. Iowa Disabled Veteran Homestead Credit.

Learn About Sales Use Tax. File a W-2 or 1099. Iowa Code Section 42515.

A surviving spouse who receives DIC payments is eligible for the credit even upon remarriage. Learn About Property Tax. Register for a Permit.

Provides information on tax credits and exemptions for Iowa State including filing questions and the application process for the homestead property tax credit and the military service tax exemption. Disabled Veteran Homestead Property Tax Credit. This legislation from the year 2014 provides 100 exemption of property taxes for 100 disabled service-connected veterans and Dependency and Indemnity Compensation DIC recipients.

Iowa Disabled Veteran Benefits for Homestead Tax Credit. The disability exemption amount changes depending on the disability rating. 5000 from the property value.

Originally adopted to encourage home ownership for disabled veterans. Department of Iowa Revenue Apply. Homestead did not receive the credit during the qualified veterans life the surviving spouse will need to provide a current DIC Dependency and Indemnity Compensation or CPD Compensation and Pension Death letter to receive the tax credit.

This application must be filed with your city or county assessor by July 1 of the assessment year. Disabled Veteran Homestead Tax Credit Sign up deadline. Iowa Code Section 42515 IDR 54-049b 070616.

There is a form that must be filed with your county assessor by July 1 of the year the property taxes are assessed. 7500 from the property value. As of now a disabled veteran in Iowa can receive up to full property tax exemption if it can be proven that his or her disability is due to military service.

You must send your claims to the Iowa Department of Revenue by November 1 2021. Iowa Disabled Veterans Homestead Tax Credit Description. Treasurers Homestead and Disabled Veterans Property Tax Credit Affidavit Original and Amended Claims Iowa Code section 4254.

Hennepin County Mn Property Tax Calculator Smartasset

What Is A Homestead Tax Exemption Smartasset

Va Disability And Property Tax Exemptions Common Misconception For A Disabled Veteran In 2021 Youtube

What Is A Homestead Tax Exemption Smartasset

Va Disability And Property Tax Exemptions Common Misconception For A Disabled Veteran In 2021 Youtube

Can The Va Take Away 100 Permanent And Total Disability Yes Here S How Va Claims Insider

Va Disability And Property Tax Exemptions Common Misconception For A Disabled Veteran In 2021 Youtube

Veterans Set For Biggest Benefit Payment Increase In Decades

Can A Homestead Exemption Lower Your Mortgage House Of Debt

Va Disability And Property Tax Exemptions Common Misconception For A Disabled Veteran In 2021 Youtube

Hennepin County Mn Property Tax Calculator Smartasset

Va Disability And Property Tax Exemptions Common Misconception For A Disabled Veteran In 2021 Youtube

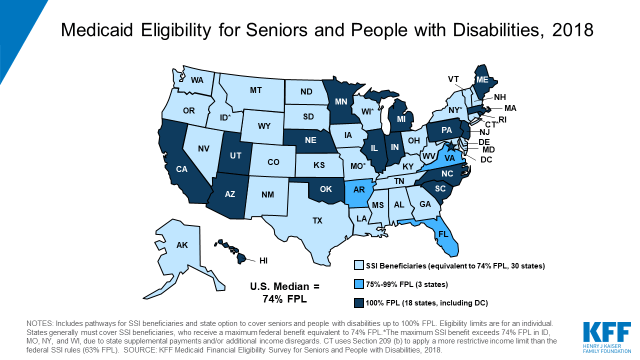

Medicaid Financial Eligibility For Seniors And People With Disabilities Findings From A 50 State Survey Issue Brief 9318 Kff

What Is A Homestead Tax Exemption Smartasset

If You Purchased A Home Last Year And It Is Your Primary Residence You May Be Entitled To A Homestead Real Estate Tax Exem New Homeowner Real Estate Estate Tax

Va Disability And Property Tax Exemptions Common Misconception For A Disabled Veteran In 2021 Youtube